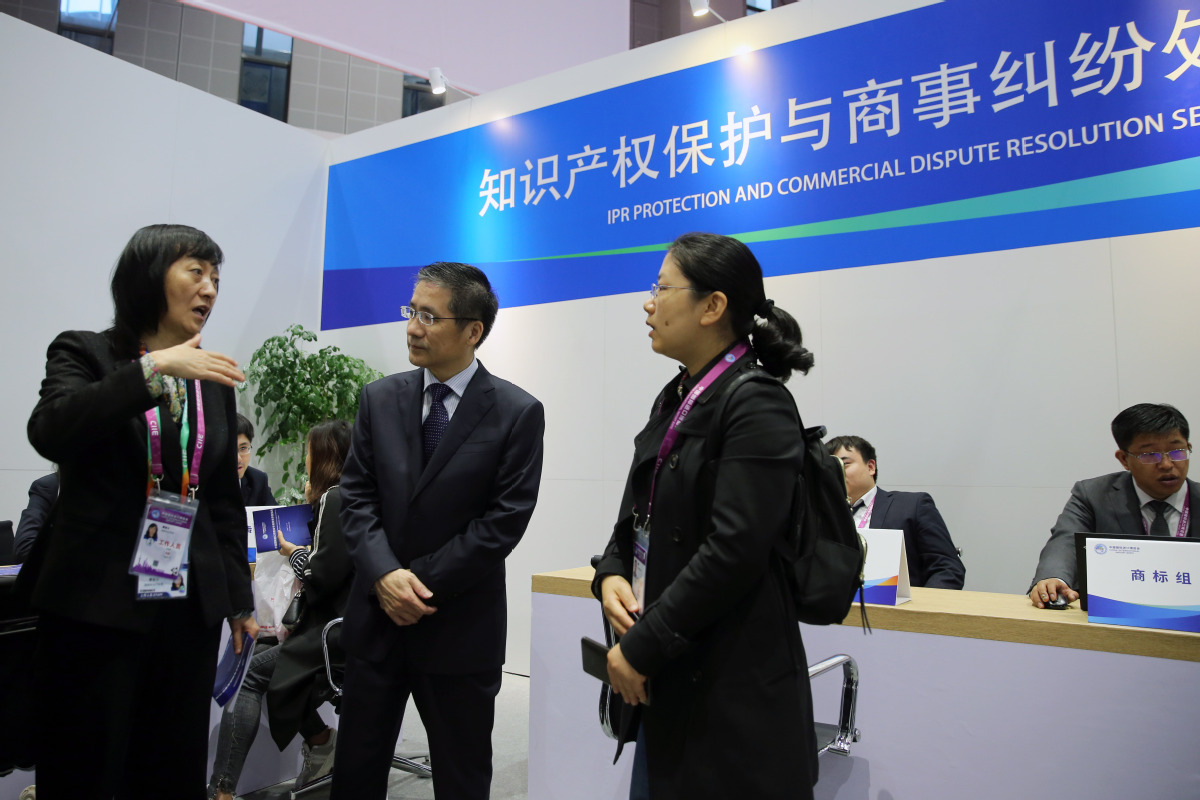

知識(shí)產(chǎn)權(quán)質(zhì)押貸款風(fēng)險(xiǎn)補(bǔ)償機(jī)制(zhīshíchǎnquán zhìyā dàikuǎn fēngxiǎn bǔcháng jīzhì): Compensation mechanism for intellectual property pledge loans

Bank loans are the main channel for small and medium-sized technology enterprises to raise funds. But due to the high risk involved in commercializing scientific and technological achievements, it is difficult for small and medium-sized science and technology enterprises to obtain sufficient credit support from banks.

This requires the government to arrange financing channels for small and medium-sized enterprises.

Intellectual property pledge loans are a new financing tool whereby enterprises or individuals use their intellectual property rights as collateral for loans from the banks. To support this new science and technology financing mode, a special fund is being set up to compensate banks if a loan is defaulted on.

A pilot program for a new compensation mechanism, led by the National Fund for Technology Transfer and Commercialization, is to be launched before the end of this year.

This innovative financing support mechanism will be implemented by both the central government and local governments. Experts expect the implementation of this loan compensation mechanism to strengthen the connections among governments, banks and enterprises and expand the scale of financing for the commercialization of research achievements.

Such a risk sharing mechanism can effectively encourage banks to provide loans to small and medium-sized technology enterprises.