Can you spot the next Labubu?

An office desk is an unlikely place for a tsunami to start. But when Labubu began popping up at workstations across China, it didn't just signal a new fad. It heralded a massive cultural wave that swept from celebrity mansions to middle income group's living rooms, and from pop-up stores in Beijing malls to the screens of millions on Xiaohongshu, or RedNote, and Douyin.

As a middle-aged observer, I find the obsession with the wide-eyed and odd-looking collectible toy both magnetic and deeply revealing. Behind the bizarre cuteness lies a question worthy of serious economic consideration: What does the popularity of Labubu and the consumer force behind it tell us about China today?

Labubu's biggest fans are unmistakably young adults, the cohort driving many of today's consumer trends. Their tastes and habits ripple far beyond entertainment, influencing industries from travel to fashion, and signaling a generational shift in what, how and why people buy.

McKinsey's research indicates that young consumers in second-tier and smaller cities drive almost 60 percent of the growth in spending. Although the younger generation makes up a relatively modest share of the population in major urban centers like Shanghai, their influence on overall consumption is disproportionately large.

The oddity is more pronounced in some sectors like travel, where younger people tend to dominate tourist numbers during major holidays. The takeaway for the corporate sector is unmistakable: China's youth are reshaping the consumer landscape with their growing purchasing power and preferences.

What's different about this new young generation of China? For one, their entire upbringing unfolded online, where information is instant and connections are effortless. This digital DNA shapes their consumption patterns and preferences. Tightly knit online communities form around niche interests, transforming even small hobbies into viable business ventures. Opinions travel fast, and leaders of digital tribes drive consumption trends with lightning speed.

Raised in an era of China's meteoric economic rise, when the country sprinted to become the world's second-largest economy, these youth have expensive tastes and high expectations. For them, quality trumps price. Maslow's hierarchy is upside down: they buy not just to meet needs but to fulfill aspirations, to seek experiences, and to express their individuality.

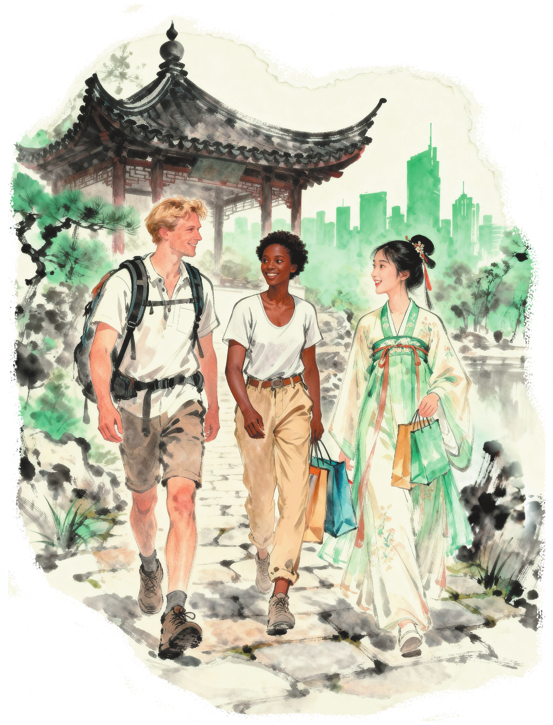

These Chinese youth have a broad international perspective but also a confident cultural identity. They consume guochao — the new wave of Chinese cultural and tech products — with enthusiasm. At the same time, there is a strong emphasis on individuality. Young travelers favor freedom and authenticity: solo trips are up, cultural immersion is prized, and digital integrated tourism complexes are hot.

Meanwhile, the "She Economy" is soaring, with female consumers spending more and leading trends. Nearly 400 million women aged 20 to 60 represent a staggering 10 trillion yuan ($1.4 trillion) in annual spending power. The rise of single-person households, now over 14 percent of all families in China, drives even more specialized spending on fashion, dining, health and travel. On average, single-person households spend 2-4 times more than households with couples.

Businesses are also aligning their products with the changes in the market conditions and consumer preferences. Traditional sectors such as cars and home appliances have passed their wild growth days but continue to be vital. The car market is seeing first-time buyers giving way to replacement and add-on purchases and young buyers rapidly becoming the main force. Cars themselves are evolving into smart, connected devices that roll up offices, social hubs, and entertainment centers in one.

Home appliances, too, are becoming smarter and more personalised. No longer just family necessities, they now cater to individual tastes and lifestyles. The future is intelligent home ecosystems and household gadgets that are customized to individual usage patterns.

Then there's the emotional and cultural side of consumption. Trendy toys like Labubu are just the tip of the iceberg. The stress-relief industry is booming, with relaxation lounges and sensory play spaces capturing the attention of the country's youth.

What do all these changes mean for businesses? To succeed in China's colossal consumer market, business must decode the preferences of young consumers. They must understand their values shaped by history and technology, their tastes, and their social realities. If an entrepreneur can find a niche or spot a trend and build a unique offering around that, he should be prepared for explosive growth.

Some scoff at Labubu, calling it "this generation's tulip bubble" or "just another fad". But in China's super-sized market, even the smallest niche can mean millions of consumers. The next big wave, the next Labubu, is out there, simmering among countless emerging subcultures and trends. Business leaders, have you spotted it yet?

The author is deputy director at the Macroeconomic Division of the Economic Forecasting Department, State Information Center.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.